Hey peeps,

I can't believe we our in December already, and Christmas is literally around the corner. From now until usually the ending of January, people, including myself, spend an immense amount of money during the Christmas and New Year sales period.

Currently the VAT (value added tax) on goods is 17.5%, but from the 4th January 2011, the VAT on goods will dramatically increase by 2.5%. To put this into perspective, if you buy an item for £100 today, the same item after 4th January would cost you £102.13.

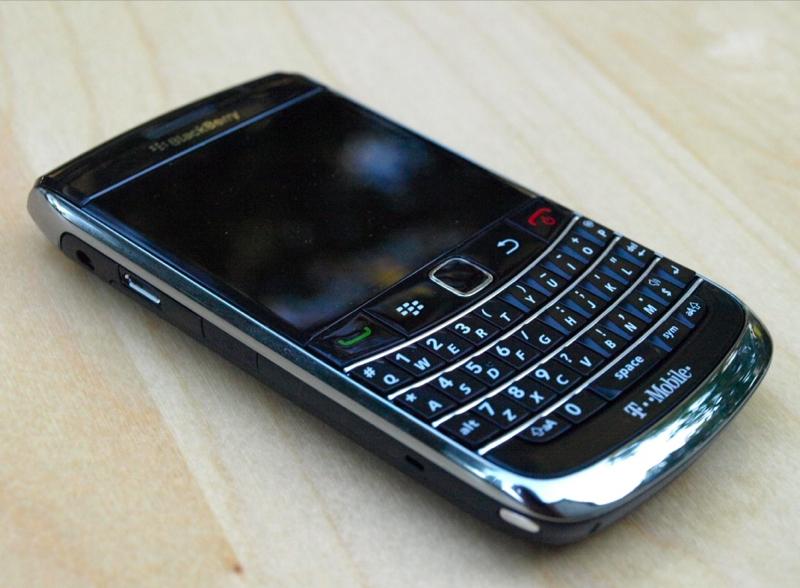

After Christmas my goal is to buy a new TV (yet again!!) during the sales, in order to avoid the hike in the VAT changes in the next few weeks.